CA Business License Application free printable template

Show details

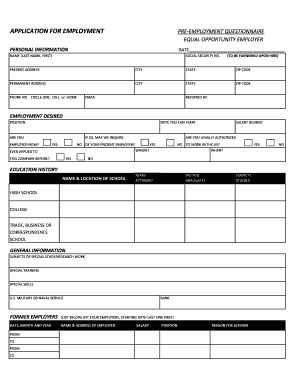

City of Tulare BUSINESS LICENSE APPLICATION City Hall- 411 E. Kern Ave. Tulare CA 93374 559 684-4232 BUSINESS NAME include DBA BUSINESS TELEPHONE NUMBER BUSINESS LOCATION Physical Address Address City State Zip BUSINESS OWNER / OFFICER INFORMATION Name of Owner/Officer Title Home Address City State Zip Home Telephone Number Driver License No. State Exp. Email Emergency / Alternate Contact Name Contact Telephone Number The Planning Building Police and Fire Departments review all business...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign city of tulare business license form

Edit your tulare business license form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business license tulare county form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing city of tulare business license renewal online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit california business license form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business license california form

How to fill out CA Business License Application

01

Gather necessary information: Prepare details about the business, including the business name, address, and ownership structure.

02

Determine the appropriate license type: Research which type of business license is required for your specific business activities.

03

Complete the application form: Fill out the CA Business License Application form accurately. Ensure all required fields are completed.

04

Provide supporting documents: Attach any required documentation, such as identification, business formation documents, and any permits.

05

Pay the application fee: Check the fee structure and include payment with your application, if applicable.

06

Submit the application: Send the completed application form and payment to the appropriate local authority or agency.

07

Wait for processing: Allow time for your application to be processed and be prepared to respond to any additional requests from the agency.

Who needs CA Business License Application?

01

Any individual or entity conducting business activities in California, including sole proprietors, partnerships, corporations, and LLCs.

02

Businesses that sell goods or services, operate a commercial space, or engage with the public may also need a CA Business License.

Fill

fresno county business license

: Try Risk Free

People Also Ask about california seller's permit application

What do I need to get a business Licence in California?

Steps to Get a California Business License A business name. An EIN (Employer Identification Number) or SSN (if you're a sole proprietor) A business entity type (LLC, partnership, corporation, etc.) A business address and phone number. A business plan that includes anticipated revenue and expenses.

How do I get a city business license in California?

How do I get a California business license? You can register for a California seller's permit online with the Department of Tax and Fee Administration. To get a local business license, contact your local government office.

How much does a California business license cost?

In general, most CA small businesses will pay between $50 and $100 for a general business license. Larger corporations may be subject to charges based on their projected revenue.

How much does it cost to apply for business license in California?

In general, most CA small businesses will pay between $50 and $100 for a general business license. Larger corporations may be subject to charges based on their projected revenue.

Do you need a city business license in California?

Any business owner must obtain a general business license in the city in which your business is located. Some California cities refer to a business license as a business tax certificate. Businesses that are operated in unincorporated sections of the state must obtain their license or tax certificate on a county basis.

How to get a business license in Cerritos CA?

Create a portal account at permits.cerritos.us. Click “Submit An Application” to apply for a new business license. Follow the instructions and ensure you have all required supplemental documentation. Resubmit After Making Corrections: Upon submitting an application, you will be notified if corrections are required.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete business license california lookup online?

pdfFiller makes it easy to finish and sign city business license online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I sign the california business license sample electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your business license in california for sole proprietorship in seconds.

How do I edit california sole proprietorship registration on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as business license lookup california. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is CA Business License Application?

The CA Business License Application is a form required by the state of California for businesses to register and obtain the necessary licenses and permits to operate legally within the state.

Who is required to file CA Business License Application?

Any individual or entity that intends to conduct business activities in California, including sole proprietors, partnerships, corporations, and limited liability companies, is required to file the CA Business License Application.

How to fill out CA Business License Application?

To fill out the CA Business License Application, you should provide details such as your business name, address, ownership structure, type of business, and any applicable fees. It's important to follow the instructions carefully and ensure all required fields are completed.

What is the purpose of CA Business License Application?

The purpose of the CA Business License Application is to ensure that businesses comply with state and local regulations, enabling authorities to track business operations, collect taxes, and enhance public safety.

What information must be reported on CA Business License Application?

The CA Business License Application generally requires reporting information such as the business name, business address, owner's name and contact information, type of business entity, and any relevant identification numbers, such as a Social Security or Employer Identification Number.

Fill out your CA Business License Application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California Business License Example is not the form you're looking for?Search for another form here.

Keywords relevant to vendor business license

Related to how to get a business license

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.